Mac OSX applications Mac OSX desktop apps

Home Inventory

Your peace of mind

A home inventory serves multiple purposes. It provides documentation of your belongings for an insurance company if your home is burglarized or damaged; it helps you keep track of items that require upkeep or repair; and (as an added bonus) it can help you declutter and maintain a lean home.

Severe weather is on the rise across the country, making it more critical than ever to ensure that your property and contents are properly insured. In 2015, there were 501,500 structure fires reported in the United States. These fires caused $10.3 billion in property damage. If your home is damaged or destroyed, it’s important that it has been insured for its accurate replacement value.

More Information

GearUp

Manage all your gear in one place

GearUp will help you maintain inventory of all the gear you own. It lets you organize your items in collections, categories, locations and/or assign one or more custom tags to each item. It helps you add photos, videos, receipts, manuals, contracts and any other document related to your items. Create and manage multiple packing lists for any type of trip you make.

More Information

Wealth Tracker

Gain complete overview of your wealth

One step to building wealth is to measure and track your financial progress. Not tracking your financial progress is like driving with your eyes closed, you have no idea where you’ve been or where you are going, and you are probably going to have an accident.

Wealth Tracker application - your best and most comprehensive tool for tracking and managing your assets and net worth. Track your wealth using your own custom asset and liability categories. Assign your tags, locations and documents to assets. Supports assets and liabilities held in foreign currencies.

More Information

Net Worth Pro 2

Net worth tracker with categories, tags and foreign currency support

Are your finances on track? Net worth is a single most comprehensive gauge of how you are doing financially. Tracking your net worth is like giving yourself a grade every month and helps keep your spending/savings for the month accountable. NetWorth Tracker will help you see where you are and track your progress over time.

Log and track your individual asset and liability categories over time. Multiple charts for net worth, total assets/liabilities, individual asset/liability categories, asset and liability distributions, ...

More Information

Millionaire

How long it will take to become a millionaire

With consistent savings and a decent interest rate on those savings, you might be able to become a millionaire. When will it happen?

More Information

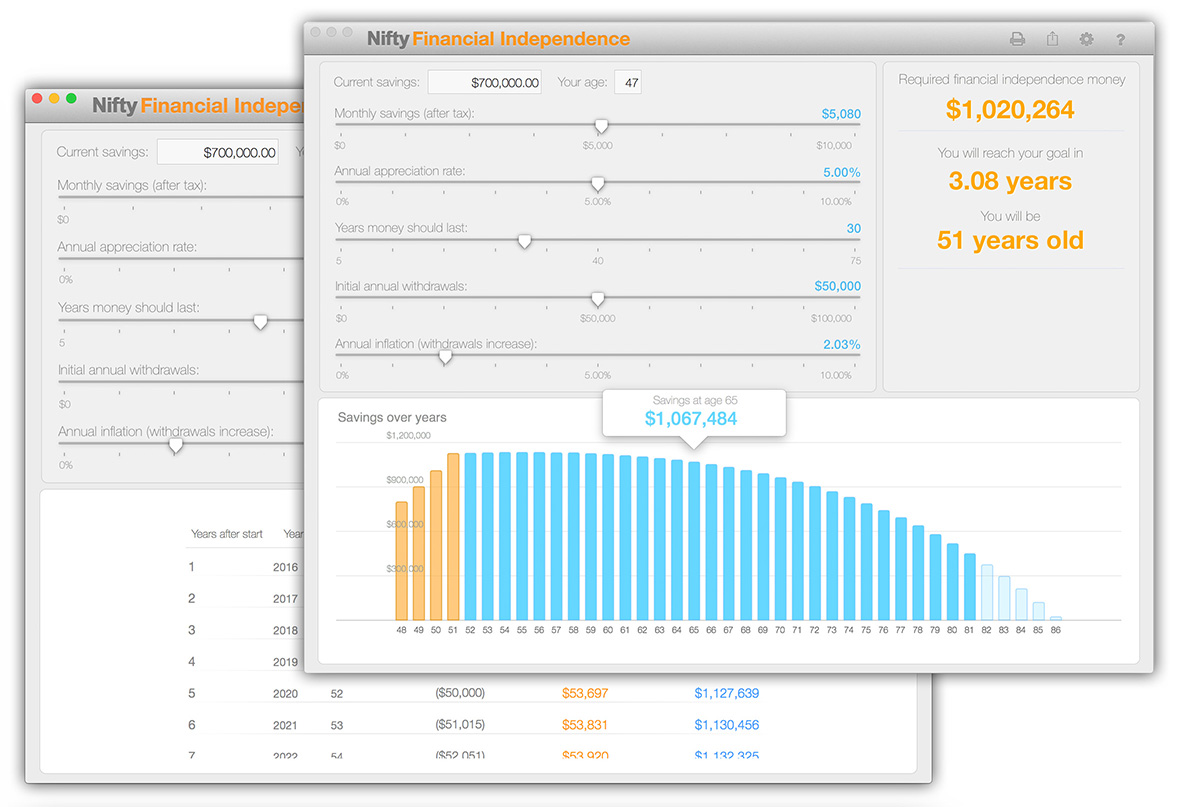

Financial Independence

Visualize your Financial Independence, or as some call it Financial Freedom. How many years will it take you to reach it? How much money will you be able to withdraw annually? Play with all parameters that affect your road to Financial Independence.

More Information

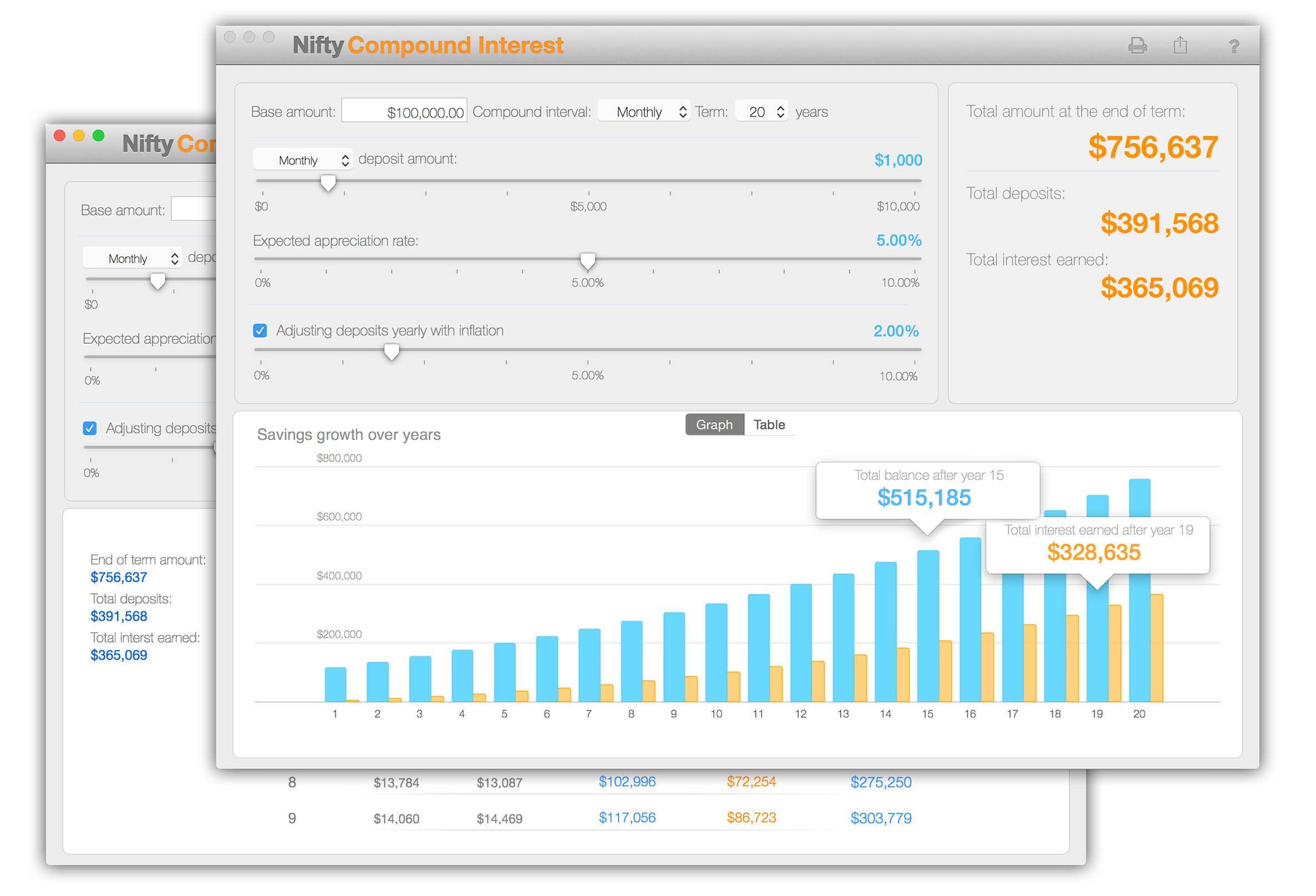

Compound Interest

Work out the compound interest on your savings

Work out the compound interest on your savings with this simple but feature-rich calculator. This calculator supports a full range of compound intervals: daily, weekly, monthly, quarterly, semi-annual and annual.

More Information

Savings Goal

Figure the amount of time it will take you to reach your savings goal

Simply input your current savings, savings goal, the amount you can save each month, and the annual interest rate (return on investment) you expect your savings to grow at.

More Information

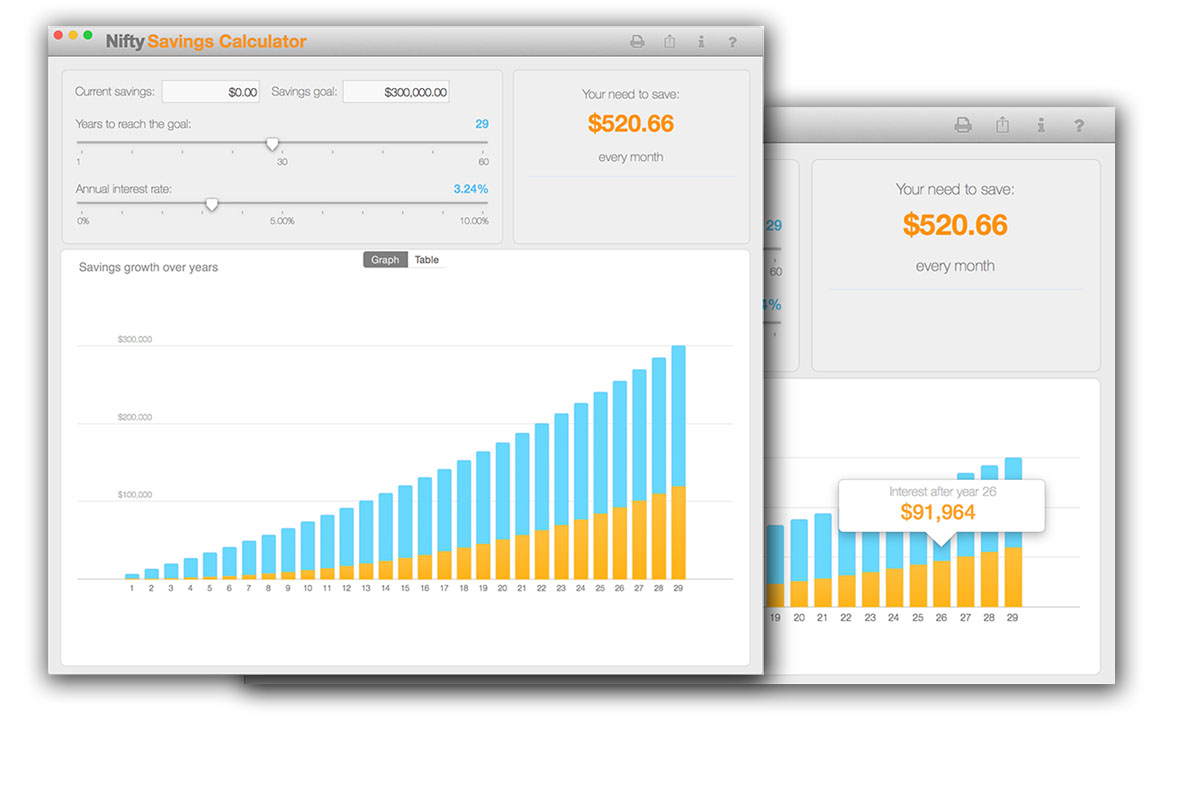

Savings Calculator

Figure out how much to save each month to reach your financial goal

Simply input your current savings, savings goal, number of years to reach your goal and the annual interest rate (return on investment) you expect your savings to grow at. The calculator will tell you how much you need to save each month.

More Information